When selecting a bank or banking services, organizations have a lot of things to consider. Indeed, you need to find a partner that offers the right combination of services, technology, terms, security, experience, proven results and more. Fortunately, issuing an RFP for banking services empowers you to weigh all of these factors. Consequently, you can make a confident, informed and data-based decision.

In this blog, we’ll explore everything you need to know about banking RFPs. First, we’ll explore some key background information including definitions, an explanation of why organizations use RFPs for banking and an overview of the types of RFPs used in banking. Next, we’ll share a how-to guide for writing and issuing a banking RFP. Finally, we’ll offer examples and a template for issuing your own banking RFP.

Before jumping into how to write a banking RFP, it’s important to understand some background. What is a banking RFP? Why do organizations use RFPs to pick banking services? And, what types of banking RFPs are there?

In banking, a request for proposal (RFP) is a questionnaire-style document issued to prospective vendors by an organization seeking banking products and services. The RFP enables organizations to easily compare each bank or firm’s offer objectively.

Selecting the right banking services is important. Using an RFP helps to reduce banking costs by ensuring that service providers offer competitive rates. Additionally, organizations can identify the vendor that best matches their culture, customer service and technology needs. Often, this strategic sourcing approach leads to longer-term relationships and better outcomes. Finally, RFPs allow organizations to minimize vendor risk by verifying and inspecting a bank or firm’s practices, security policies and compliance with regulations.

For municipalities and other government organizations, the RFP process may be required by regulation. Alternatively, it is often used to ensure that the organization meets their fiduciary duty.

Generally, banking services RFPs deal with the day to day transactions of a business. However, there are lots of other kinds of financial services RFPs. For example, investment management RFPs, investment consulting RFPs, asset manager RFPs, outsourced financial accounting RFPs, financial strategy services RFPs and so on.

To see a template, download this sample investment management RFP.

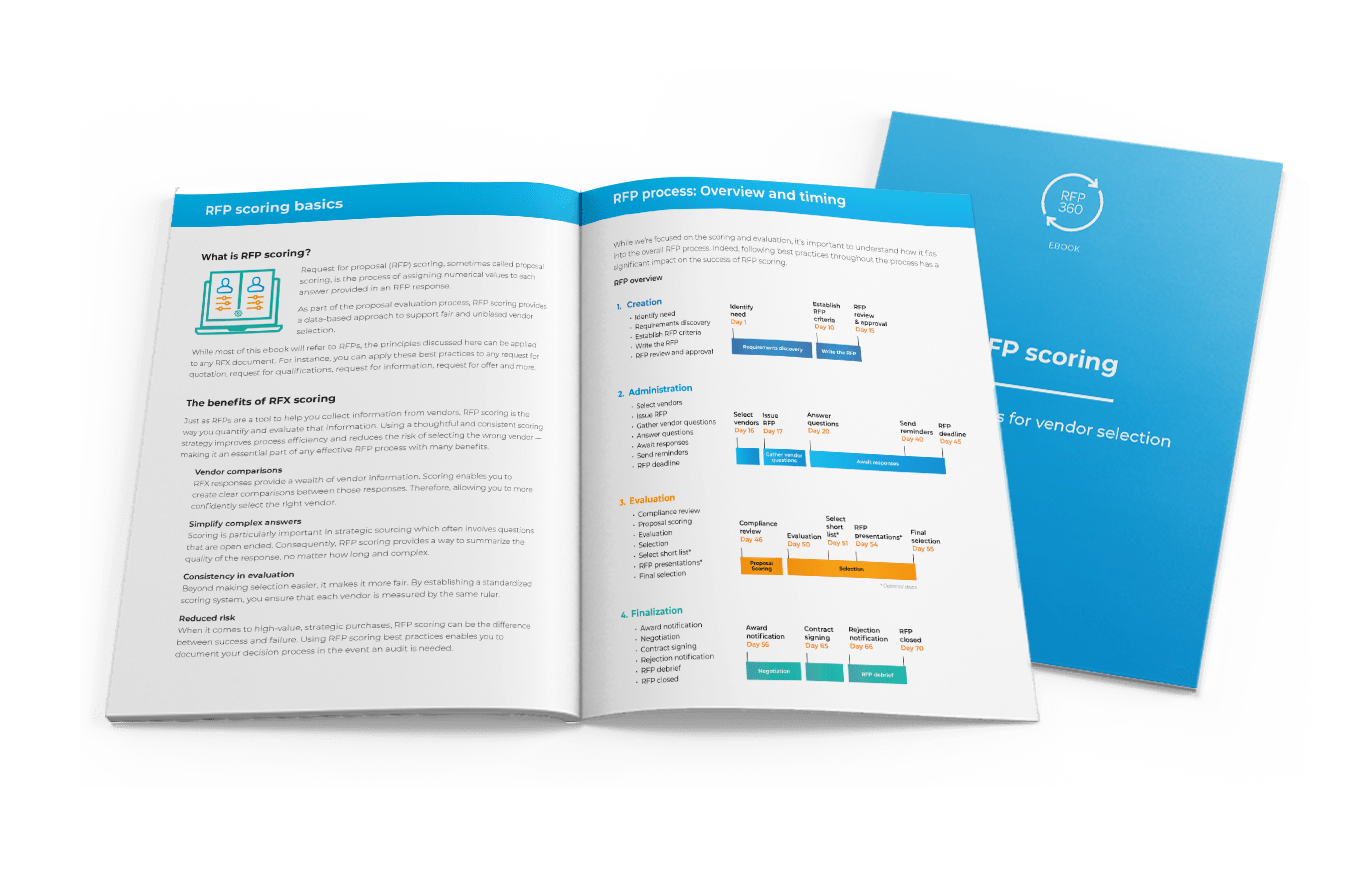

Banking RFPs follow the same three basic steps as any other RFP: creation, administration and evaluation. Most of the customization required to issue a thoughtful banking RFP happens in the first step, so that’s the primary focus of the following guide.

While we’ll provide an overview of all three steps, you may want to download the RFP process guide ebook for more in-depth information about RFP administration and evaluation.

Ideally, most organizations issue bank RFPs every two or three years. Consequently, you may not be an expert on the current banking industry. That’s why it’s important to interview and collaborate with stakeholders who regularly interact with a banking services provider.

Stakeholders for your banking services RFP likely include the finance, human resources and legal teams. Additionally, you may need to work with the executive responsible for final approval or board members. As you identify your RFP team and conduct interviews, it’s important to discuss the current state of banking services as well as goals for the project. In addition, brainstorm a list of needs and wants.

Using the information you gathered from your stakeholders, you’ll work to clearly define your project and priorities. Be sure to include as much detail as possible. Indeed, accurate and thorough proposals depend on the information you include in the background and scope sections of your RFP. An article from IncredibleBank discusses what to include and why:

“Providing information regarding the number and type of bank accounts, average annual collected balances in those accounts and the associated interest rates allows the financial institution to customize a proposal specific for your municipality. Volume of activity such as number of deposits, checks, and checks deposited on a monthly basis as well as the volume of electronic transactions – both incoming and outgoing – are also important as most banks have various accounts in their offering with requirements based on transaction volume. Having the best information available to recommend the appropriate account type is a key first step in the structure of a deposit relationship.”

In addition to outlining your specific banking requirements, it’s important to organize your priorities. Take your list of needs and wants and categorize them. This is how you’ll build your RFP sections and RFP evaluation criteria. For example, your highest priorities may be customer service, account management technology and fee structure. Decide the weight of each section. Then, use this information to establish your RFP weighted scoring.

Now that you’ve interviewed stakeholders, defined your project and established your priorities, you can put it all together in your RFP.

Once you’ve written your RFP, it’s time for supplier selection. Ideally, most organizations want to end up with three qualified vendors to choose from. With that in mind, you may find it useful to issue a brief request for information (RFI) to explore the market, gauge interest and narrow your vendor selection to a short list of about six options.

Now it’s time to send your email to banks and financial institutions so they can begin preparing a proposal. If you manage the RFP process manually using Word and spreadsheets, you’ll likely send your RFP invitation to vendors using individual emails.

As you can imagine, sending an RFP via email creates chaos in your inbox. So, if you want to make the process faster and easier, consider using an RFP management system. Designed to centralize and automate every step of the RFP process, RFP tools improve collaboration and cut the time required to issue an RFP by up to half.

Often, vendors will have follow-up questions after reading your RFP. They may need clarification on a requirement or want more details about your needs. Regardless, it’s best practice to gather all vendor questions and answer them in a single document. By providing all questions and answers to each vendor, you ensure that no one gains an advantage.

Once again, responding to vendor questions is much easier in a request for proposal tool that centralizes communications and allows you to track real-time vendor progress.

As your RFP deadline approaches, it’s helpful to send vendors a quick and gentle deadline reminder. Remember to let them know you’re excited to see their proposal and offer the anticipated date of your final decision.

Using the criteria you established previously, assign your project stakeholders sections of your RFP to score. For instance, your finance team that regularly works with the bank should score sections that cover banking approach, customer service and statements. The IT department should score sections that deal with data security. And, human resources should score any sections that deal with employee interactions.

When scoring, direct stakeholders to refer back to the evaluation criteria you established earlier. As you review scores, take the opportunity to compare feedback from various stakeholders to ensure that you address any discrepancies between scorers.

For more information about RFP scoring and examples of several approaches, download the RFP scoring guide.

Finally, it’s time to select your vendor. Compare the total scores for all vendors. Hopefully you have a clear, data-based winner. If so, let them know the good news with an RFP award letter before moving on to negotiation, contracting and execution.

If you don’t have a clear winner, you may need to narrow your selection down to a list of finalists and ask a few more questions, request customer reference calls or host an RFP presentation.

Once you have a signed contract, be sure to follow up with unsuccessful vendors. While sending an RFP rejection letter seems harsh, vendors often find it helpful to identify areas for improvement. Whenever possible, offer to connect with vendors to answer questions in an RFP debrief session to offer detailed feedback.

One of the best ways to decide what your RFP should include and look like is to review other examples. Below you’ll find several helpful sample RFPs for banking services. Use these RFP examples to inspire yours, but remember, it’s crucial to carefully customize every RFP to meet your specific needs.

This RFP, issued by a nonprofit organization, is relatively brief at only five pages long. However, within the document, you’ll find an overview, scope of work, required services and instructions for proposals.

Featuring a detailed description of the county’s banking practices including information about stakeholders and logistics, this RFP example is excellent. You’ll also see detailed instructions and clear RFP section weights for scoring. Additionally, this RFP includes a helpful yes or no checklist that quickly guides banks through the minimum requirements.

The details contained in this RFP for comprehensive banking services are crucial for encouraging vendor engagement and ensuring accurate responses. In addition to the easy-to-read format, the appendixes include information about transaction and services volume and desired account structure.

This example RFP is 40 pages and full of detail. Indeed, the RFP includes terms and conditions, submission requirements, evaluation information, a clear scope of work and a helpful RFP pricing table to make comparing fees easy. In addition you can review the results of this RFP in their weighted scoring document.

This banking services RFP template allows you to fill in the blanks and customize its content to your needs. At only six pages, you may need to add some detail, but it’s a great starting point for your next bank RFP.

As with any strategic sourcing project, it’s important to focus on overall value when selecting your next banking services provider. Hopefully, armed with information, examples and a template, you’ll manage your next RFP with ease.

Find out why leading response teams across the world turn to Responsive for their Strategic Response Management and RFP software needs.