If you are a business owner seeking to cancel your insurance policy with your provider, it is important to follow the established procedures set by your insurance company. This is particularly crucial for small businesses. You may also have personal insurance policies that you wish to cancel for various reasons. In either case, the first step is to initiate the process by submitting a written policy cancellation letter.

Table of Contents

An insurance cancellation letter is a formal written document that is submitted to an insurance company to request the termination or cancellation of an existing insurance policy. The letter serves as a written record of the policyholder’s intention to discontinue the insurance coverage and outlines important details such as the policy number, effective date of cancellation, reasons for the cancellation, and any required supporting documentation.

It is typically necessary to follow the specific procedures and guidelines provided by the insurance company when drafting and submitting an insurance cancellation letter to ensure a proper and timely cancellation of the policy.

Insurance cancellation is a common occurrence in the ever-changing landscape of personal and business needs. Whether you’re an individual looking to terminate your auto, home, or health insurance, or a business owner seeking to cancel a commercial policy, the process can often be complex and time-consuming. However, with the availability of insurance cancellation letter templates, this task can be made significantly easier and more efficient. In this article, we will explore the benefits and features of these templates, which can assist you in crafting a comprehensive and professional insurance cancellation letter.

Insurance cancellation letter templates are indispensable resources that simplify the process of terminating an insurance policy. By providing a structured framework and customizable content, these templates allow individuals and businesses to communicate their cancellation intentions clearly, concisely, and professionally. Utilizing these templates not only saves time and effort but also ensures compliance with legal requirements, enhancing the overall efficiency and effectiveness of the cancellation process. With insurance cancellation letter templates at your disposal, you can streamline the termination of your policies, providing peace of mind and enabling you to focus on your evolving insurance needs.

When writing an insurance cancellation letter, it is important to include the following information:

Policyholder’s information: Begin the letter by providing your full name, address, and contact information. Include any relevant policy identification numbers.

Date: Include the date on which the letter is being written.

Insurance company details: Address the letter to the appropriate department or individual at the insurance company. Include the company’s name, address, and contact information.

Policy information: Clearly state the policy number, policy type (e.g., auto insurance, home insurance), and the effective date of the policy you wish to cancel.

Reason for cancellation: Briefly explain the reason for canceling the insurance policy. Be concise and straightforward. Common reasons include switching providers, selling a vehicle or property, or finding more affordable coverage.

Supporting documentation: If there are any supporting documents required for the cancellation, such as proof of alternative coverage or a bill of sale, mention that you have enclosed them with the letter.

Request for confirmation: Ask for a written confirmation of the policy cancellation. This can help ensure that the cancellation is processed correctly.

Contact information: Provide your contact information once again, including your phone number and email address. This allows the insurance company to reach you if they need further information or clarification.

Closing: End the letter with a polite closing, such as “Sincerely” or “Thank you.” Sign your name below the closing.

Enclosures: If you are including any additional documents with the letter, such as proof of new coverage, list them as enclosures at the bottom of the letter.

Cancellation of an insurance policy , whether for a small business or personal coverage, should not be taken lightly, particularly in today’s volatile environment. Before proceeding with cancellation, it is crucial to evaluate the potential impact on your personal and business finances.

Conduct thorough research and obtain quotes from multiple companies if you are contemplating replacing your existing policy with a cheaper, more suitable, or superior alternative. Here are some factors to consider when contemplating cancellation:

Cost: Assess whether you believe you are paying too much for your current policy and if alternative options are available at a more reasonable price.

Changing Coverage Needs: If your business has undergone changes or your insurance requirements have evolved, ensure that the new coverage plan adequately addresses your updated needs.

Relocation: If you plan to move to a different state where your current insurance provider does not offer coverage, it may be necessary to seek a new policy from a provider operating in your new location.

Dissatisfaction with Service: If you are dissatisfied with the service provided by your current insurance company, it may be worth exploring other options that offer better customer support and responsiveness.

Bundling Policies: Consolidating multiple policies into a bundled package could potentially result in cost savings. Consider whether combining your policies into a single package would be more affordable and provide adequate coverage.

Exposure to Expensive Claims: By canceling your insurance without securing a new policy, your business may become vulnerable to costly claims, such as lawsuits. It is crucial to have a safety net in place to protect against significant losses.

Coverage Gap with Claims-Made Policies: If your existing policy operates on a claims-made basis, canceling it could create a coverage gap for past events. Consult with your insurance company to explore options such as tail coverage or an extended reporting period (ERP) that allow for continued coverage of past incidents even after policy cancellation.

Balancing Cost Savings and Protection: While saving money is important, it is essential to assess the potential impact of canceling your policy on the overall protection of your business. Adjusting your coverage may be a more suitable option, particularly if your business or industry has undergone changes. Evaluating coverage adjustments based on your new circumstances can help ensure adequate protection without completely canceling the policy.

Before making a final decision, it is advisable to consult with insurance professionals who can provide guidance based on your specific needs and circumstances.

When you have made the decision to cancel your current insurance policy and transition to a new one with a different insurance company, it is crucial to be well-prepared for the process. Consider the following important factors as you get ready for the policy cancellation:

Secure a new policy: Before canceling your existing insurance policy, ensure that you have a new policy ready to take effect immediately. If your goal is to find a policy that offers comparable or better coverage at a more affordable price, utilize online quote engines to explore your options. Additionally, make sure to complete any necessary paperwork required by the new insurance company before proceeding.

Avoid coverage gaps: It is vital to prevent any gaps in your insurance coverage. Some individuals may be tempted to leave a short period without insurance coverage to save a small amount of money. However, this can have negative consequences, as insurance companies view coverage gaps unfavorably and it may result in higher insurance rates . Take the time to plan your policy cancellation carefully, ensuring that there is a seamless transition between the end date of your existing policy and the start date of your new policy.

By preparing in advance and adhering to these considerations, you can smoothly transition from your current insurance policy to a new one without experiencing any gaps in coverage or unfavorable consequences.

Cancelling an insurance policy requires following specific procedures and guidelines set by your insurance company. While the exact process may vary depending on the company and type of policy, here is a comprehensive guide on how to cancel your insurance policy:

Review your policy: Carefully review your insurance policy to understand the cancellation terms, notice period, and any potential fees or penalties associated with cancellation. Make note of any specific instructions provided by your insurance company.

Contact your insurance company: Reach out to your insurance company’s customer service department or agent to initiate the cancellation process. Obtain the necessary contact information from your policy documents or the company’s website.

Provide policy details: When speaking with the representative, be ready to provide your policy number, personal details, and any other relevant information they may require to locate your policy in their system.

State your intent to cancel: Clearly express your intention to cancel the insurance policy. Specify the effective date on which you want the cancellation to take effect. This is usually the end of the current policy term or a specific future date, depending on the notice period.

Follow instructions: Follow any specific instructions provided by the insurance company regarding the cancellation process. They may require you to submit a written cancellation request or fill out a cancellation form.

Submit a written cancellation letter: If a written cancellation request is necessary, prepare a formal letter addressing it to the appropriate department or individual at the insurance company. Include your policy details, effective cancellation date, and reasons for cancellation. Keep a copy of the letter for your records.

Return documents and cancel automatic payments: If you received any policy documents, membership cards, or certificates, return them to the insurance company. Additionally, if you have set up automatic payments, notify your bank or credit card provider to cancel those payments.

Confirm the cancellation: Request written confirmation of the cancellation from your insurance company. This confirmation should include the effective cancellation date and any refund details, if applicable. Keep this confirmation for your records as proof of cancellation.

Review any financial obligations: If you have outstanding premiums or owe any money to the insurance company, settle those payments promptly to avoid any issues.

Secure new coverage, if needed: If you are cancelling your insurance policy without immediately replacing it, consider obtaining new coverage to ensure you remain protected.

It is essential to note that each insurance company has its own procedures and requirements for policy cancellations. Always consult your policy documents or contact your insurance company directly to ensure you follow the specific steps they outline.

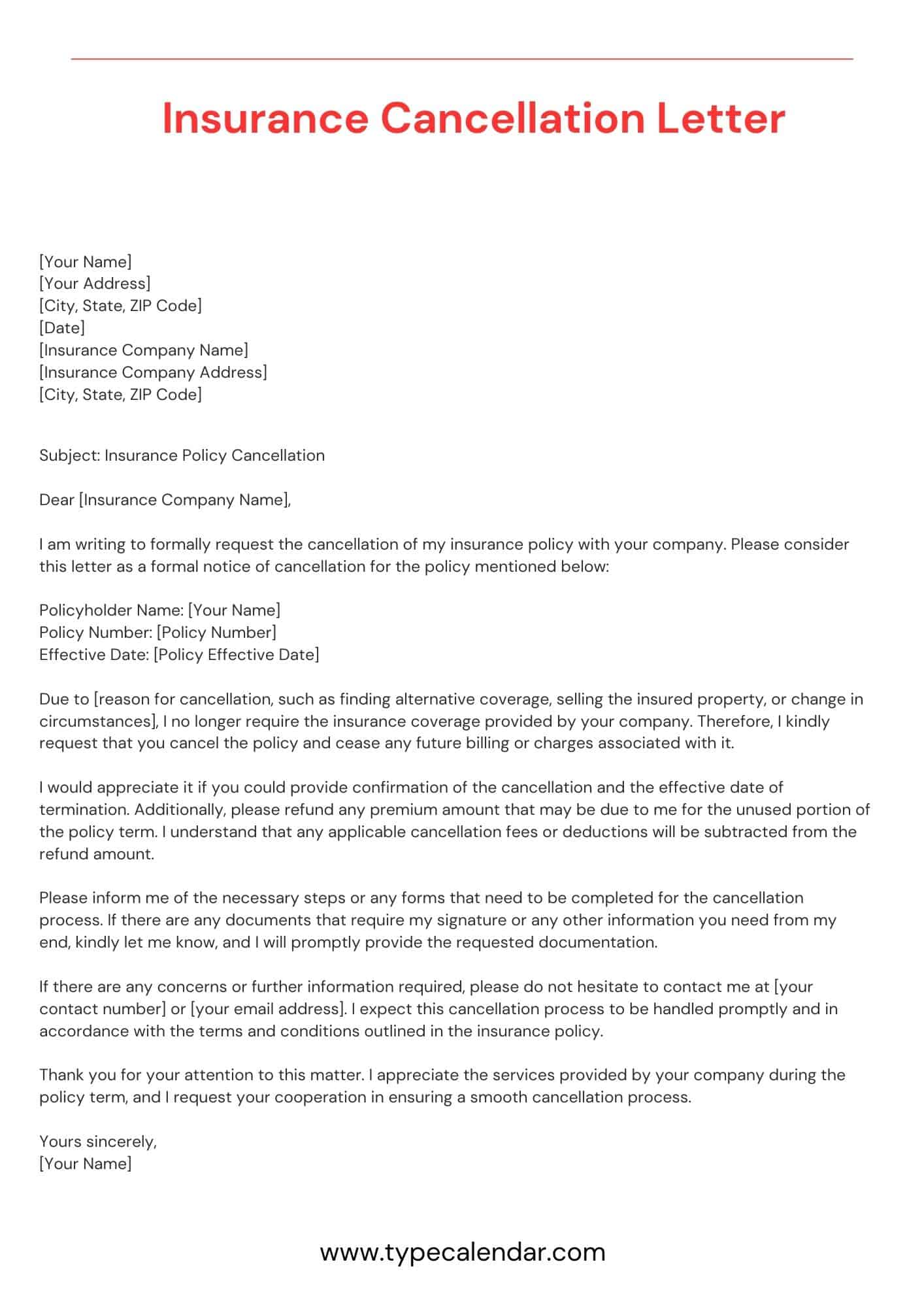

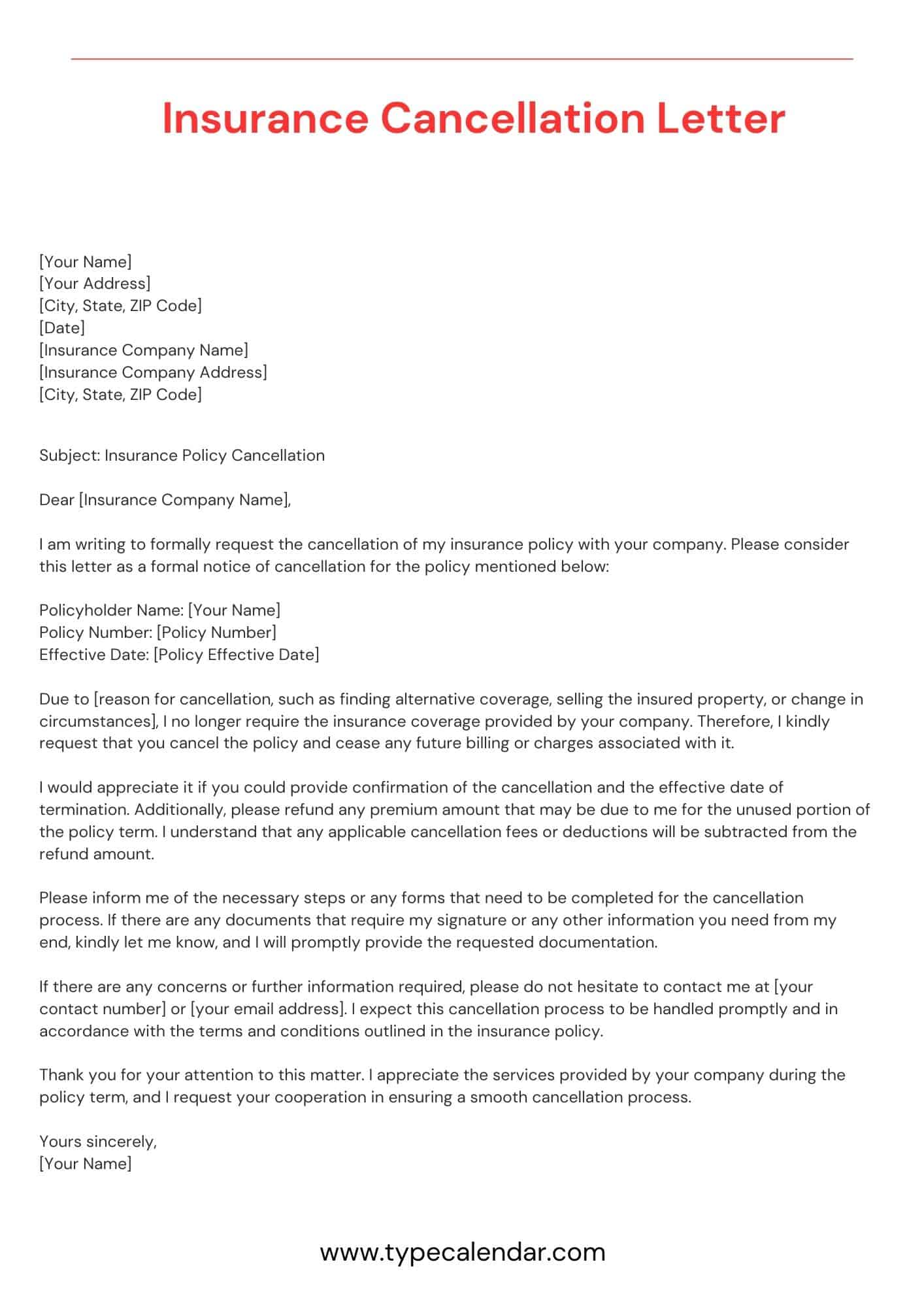

Writing an insurance cancellation letter involves several steps to ensure that your request is properly documented and processed. Here is a step-by-step guide on how to write an insurance cancellation letter:

Step 1: Review your policy

Carefully review your insurance policy to understand the cancellation terms, notice period, and any specific instructions provided by the insurance company.

Step 2: Format the letter

Use a professional and formal business letter format. Include your contact information (name, address, phone number, and email) at the top, followed by the date.

Step 3: Address the recipient

Address the letter to the appropriate department or individual at the insurance company. If you have a contact name or department name, use that information. Otherwise, address it to the “Customer Service Department.”

Step 4: State the intent to cancel

Begin the letter by clearly stating your intention to cancel the insurance policy. Include the policy number and type of insurance (e.g., auto, home, life) to ensure accurate identification.

Step 5: Provide reasons (optional)

If desired, briefly explain the reasons for canceling the policy. This step is not always necessary, but it can help provide context for the cancellation.

Step 6: Specify the effective cancellation date

Clearly state the date on which you want the cancellation to take effect. This is typically the end of the current policy term or a specific future date, depending on the notice period required by the insurance company.

Step 7: Request confirmation

Politely request written confirmation of the cancellation. Ask the insurance company to send a confirmation letter or email with the effective cancellation date and any refund details, if applicable.

Step 8: Provide contact information

Include your contact information once again at the end of the letter. This allows the insurance company to reach you if they need additional information or have any questions regarding the cancellation.

Step 9: Sign the letter

Sign the letter using your full name below the closing. If you printed the letter, you can also sign it by hand after printing.

Step 10: Keep a copy

Make a copy of the cancellation letter for your records. This serves as proof that you initiated the cancellation and can be useful if any issues arise.

Step 11: Send the letter

Send the cancellation letter via certified mail or another reliable delivery method. Request a return receipt to confirm that the letter was received by the insurance company.

After the cancellation of your insurance policy, there are several important things that may occur:

Notification to the state: Your auto insurance company will inform the state that you are no longer insured with them. It is essential to note that driving without insurance is illegal in nearly all states. As a result, your local Department of Motor Vehicles (DMV) may require proof that you have either sold your vehicle or obtained a new insurance policy. Failure to provide this proof may lead to the suspension of your driver’s license or registration, and you may be required to surrender your license plates.

Refund and cancellation fees: If there is remaining time left on your policy, your insurance company may issue a prorated refund of the premium from your most recent payment. However, some companies may charge a fee for canceling your policy before its intended expiration date. Be aware of these potential financial implications when canceling your policy.

Ensuring seamless coverage transition: If you are changing to a new insurance policy, it is crucial to ensure that the new policy takes effect before canceling the existing one. This helps prevent any gaps in coverage, as lapses in insurance, particularly for auto insurance, are generally not legal. If you have a car lease or loan that is not fully paid, it is important to notify the lending institution about your policy switch.

Proof of insurance for moving to a new state: If the reason for canceling your policy is a planned move to a different state, you may be required to provide proof of insurance when registering your car in the new state. Each state has its own rules regarding the types and amounts of insurance coverage required, so it is essential to familiarize yourself with the specific requirements of your new state.

Varying regulations and processes: It is important to keep in mind that different states have different regulations regarding insurance coverage, and insurance companies may have their own cancellation processes. To navigate this effectively, it is advisable to consult with an insurance agent or carefully review your existing policy before drafting your insurance cancellation letter.

Providing a reason for canceling your insurance policy is optional. While it can help provide context, it is not always necessary. If you choose to include a reason, keep it concise and to the point.

While there is no strict template, it is recommended to use a professional and formal business letter format. Include your contact information, the date, recipient’s details, a clear statement of intent to cancel, effective cancellation date, and a polite request for written confirmation.

It is advisable to send the insurance cancellation letter via certified mail or another reliable delivery method that provides proof of receipt. Requesting a return receipt will ensure you have evidence that the letter was received by the insurance company.

After sending the insurance cancellation letter, the insurance company will process your request. They may issue a written confirmation of the cancellation, refund any applicable premiums on a prorated basis, and notify relevant authorities or departments, such as the DMV (in the case of auto insurance).

Consulting with an insurance agent is beneficial, especially if you have specific questions or concerns about the cancellation process. They can provide guidance, clarify any doubts, and ensure you are following the correct procedures.

The notice period for canceling an insurance policy can vary depending on the insurance company and the type of policy. It is typically mentioned in the policy documents. Common notice periods range from 10 to 30 days. It is important to adhere to the notice period to ensure a smooth cancellation process.

If you cancel your insurance policy before its expiration date, you may be eligible for a refund of the premium for the unused portion of the policy. However, this depends on the insurance company’s refund policy and any applicable fees for early cancellation. Review your policy documents or contact your insurance company to understand their specific refund procedures.

Generally, insurance policies can be canceled at any time. However, there may be certain restrictions or penalties associated with canceling before the policy’s intended expiration date. Review your policy documents or contact your insurance company to understand any specific limitations or fees for early cancellation.

Yes, an insurance company can cancel your policy under certain circumstances. This can include non-payment of premiums, material misrepresentation on the application, or significant changes in risk factors. The specific cancellation terms and conditions are outlined in your policy documents.

Canceling your insurance policy does not directly impact your credit score. However, if you have outstanding premium payments or unpaid fees associated with the policy, it may affect your credit score if those payments are not resolved. It is important to settle any financial obligations with the insurance company before canceling the policy.

In some cases, it may be possible to reinstate a canceled insurance policy. This usually depends on the insurance company’s policies and the reasons for cancellation. Contact your insurance company as soon as possible if you wish to explore the possibility of reinstating your policy.

If you change your mind after sending the cancellation letter, contact your insurance company immediately to inform them of your decision. They will guide you on the next steps based on their internal policies and the timeline of your cancellation request.